One of our clients needed a way to avoid charging tax on a sales order for one of their customers if that customer purchased a part in a specific part category. If any other customer orders that exact part, the normal tax rules will apply; if the customer orders a part outside of that specific part category, normal tax rules also apply.

Here's one way to adjust how you work with sales tax in Sage X3.

Two additional tax determinations are required to accomplish this business feat:

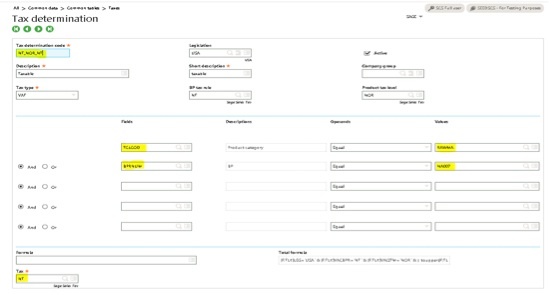

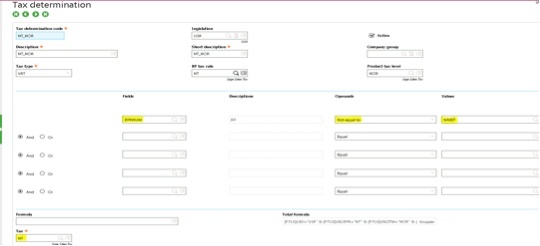

Go to Common Data > Common Tables > Taxes > Tax Determination

Request a Sage X3 Demo »

This tax determination is set up as follows: Customer = No Tax, Product Category = Tax, but if the Part Category is equal to the specific Part Category and only that customer, then do not charge TAX (NT_NOR_NT). As you can see, we named the Tax determination code NT_NOR_NT. In the example below, the Product Category is RAWMA and the BPNUM is NA007. The tax is set to NT.

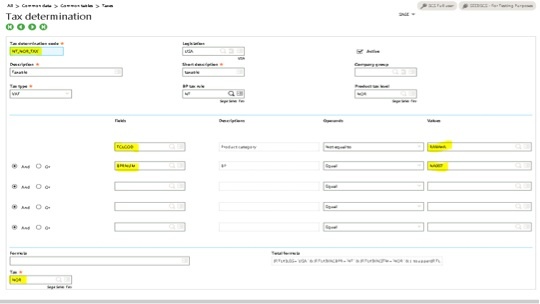

For this tax determination, the part number is not equal to the requested part category and the customer number equals the specific customer. You want the sales order to charge tax on any part not in the specific category (NT_NOR_TAX); in this example, we set the tax determination code to NT_NOR_TAX. The Product category is not equal to RAWMA and the BP is set to NA007. When these conditions are met, the Tax is set to NOR.

You need to modify the NT_NOR Tax determination to take affect only if it is NOT your specific customer.

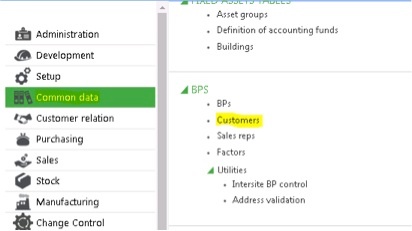

Once you have the tax determinations configured, go to Common data > BPs > Customers to update the customer tax rule.

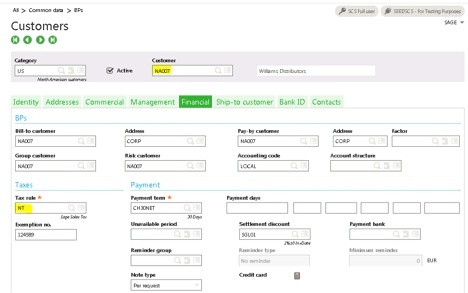

In the Customer record, go to the Financial tab and assign NT to the Tax rule. Remember to save!

Due to the flexibility Sage X3 offers, we're usually able to meet our customers’ needs with a few simple configurations. If you have questions about the above process, or any other questions about Sage Enterprise Management (or any other software, for that matter!), please don’t hesitate to contact us.

Talk to Us About Sage Software Support

|

|