There are some additional setup considerations that should to be addressed when processing 1099’s from Sage X3. Remember that Sage X3 is robust enough to manage the ERP functions of a GLOBAL enterprise (and all that entails), so it’s only natural that an organization will need to account for U.S.-specific processes. Below are the steps that will take us through the setups/configurations required to ensure your Sage EM system is “1099-ready”, as well as a small example to drive the point home.

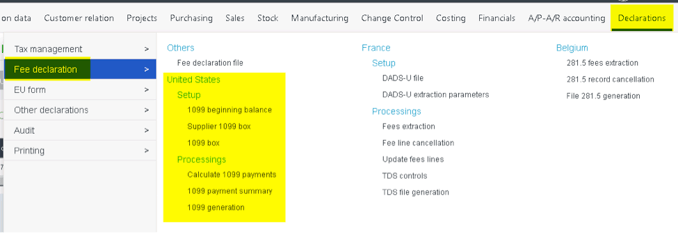

1. Navigate to the Declarations module, Fee Declaration Block and make sure you’re able to see the “United States” section:

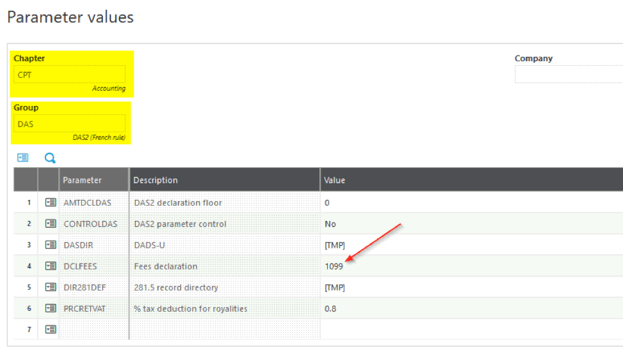

2. We’ll need to confirm that the DCFEES General Parameter has a value of “1099”

3. After we’re sure that we’ve got the available functions and that the General Parameter has the appropriate value, then we can review the 1099 Box function for accuracy:

*Before continuing on w/ the next set of steps, we will be working under the assumptions that the Suppliers have been setup to allow for 1099 processing (the below screenshot was taken from the Financial tab)

And that Supplier BP Invoices (and/or Purchasing Invoices) captured all the 1099 amounts (the below screenshot was taken from Header tab of a Supplier BP Invoice)

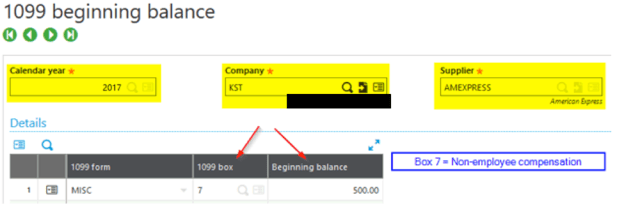

4. If there was a “mid-year” conversion/migration, and Suppliers have outstanding 1099 amounts in a legacy system, then the 1099 Beginning Balance function must be filled out by Calendar Year, Company and Supplier:

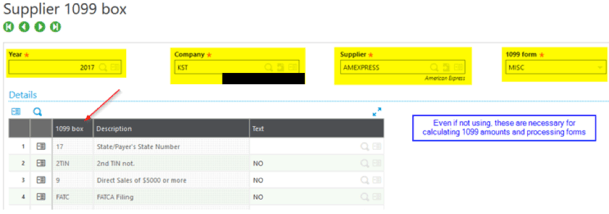

5. Additionally, the Supplier 1099 Box function will need to filled out correctly, as it is necessary for calculating 1099 amounts and for processing forms:

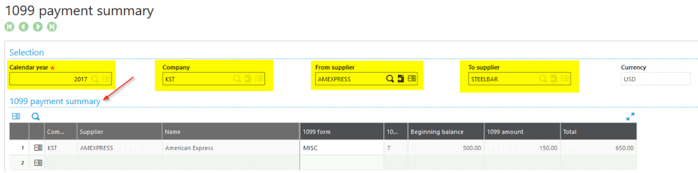

6. The 1099 Payment Summary function serves as a review/research function, which us to “see” the total of the 1099 amounts that have been entered into Sage X3, for a particular Supplier. If a “mid-year” conversion/migration was carried out, this would be a great tool to use to verify that all 1099 amounts are correct:

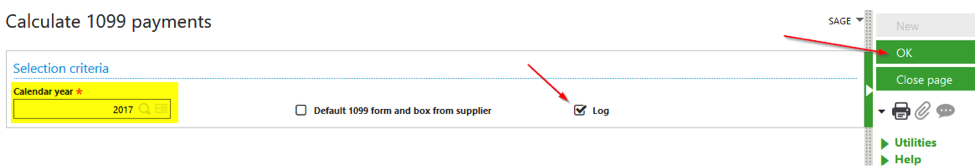

7. Assuming all of the 1099 amounts are correct, we are now ready to process 1099 Suppliers, via the Calculate 1099 Payments function. Think of this function as the “pre-printing” process that needs to be run BEFORE printing the actual 1099 forms:

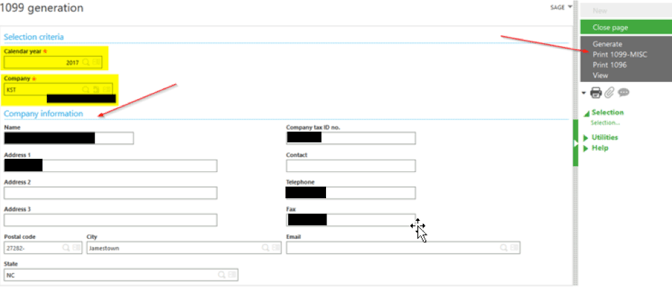

8. The 1099 Generation function will be used to “physically print” the amounts onto the 1099 pre-printed form:

That’s all you need to do!

Hopefully this blog post has been instrumental in conveying the additional considerations required when processing 1099s.

-1.png)